New Students

US Loan information for new students

Please note, if you have not yet heard from us about your FAFSA for the 2022-2023 academic year, please contact us.

If you are intending to take out either Federal or Private US loans as a new student in the 2023-2024 academic session, please follow the guidance below.

Eligibility

Students receiving US Federal Aid are governed by stringent US Department of Education regulations. Borrowing is intended for on campus study only.

In order to be eligible to borrow US Federal loans, you MUST:

| be studying on campus | be enrolled on an eligible programme of study |

|

be enrolled at least half-time for the period for which the loan is originated (PhD students who have submitted their thesis for examination do not meet this requirement) |

be fully matriculated |

| comply with the University's Satisfactory Academic Progression policy | have a high school diploma |

| not be in default on an educational loan and must not owe a repayment on an adjusted federal grant | be a US citizen or eligible non-citizen with a valid Social Security number |

| The following programmes are NOT eligible for Federal loans at the University of Edinburgh: | |

| All Online Learning Programmes | EdD (Doctorate of Education) - distinct from PhD Education which is eligible |

| All PhD by Distance Programmes | MSc Chinese Studies |

| Undergraduate MBChB | All Diploma Programmes |

| Bachelor of Nursing | All Certificate Programmes |

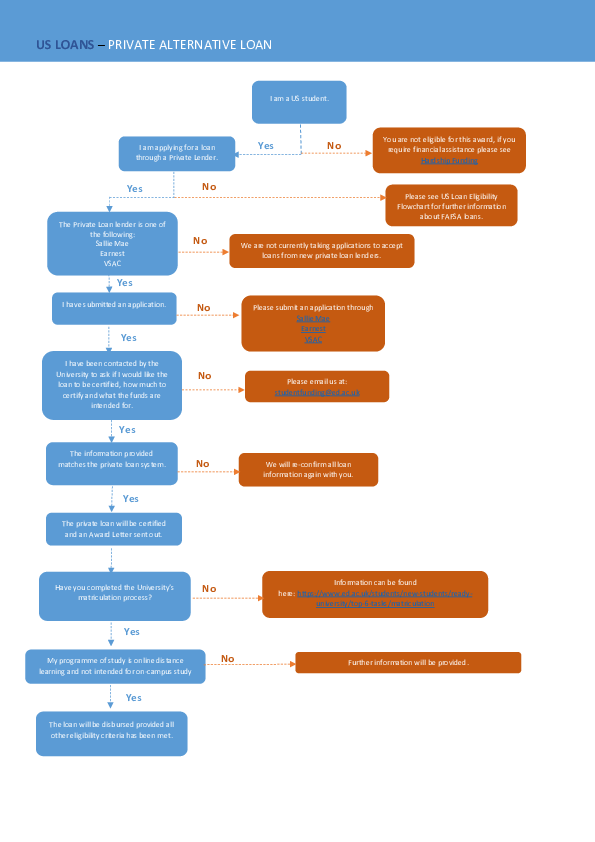

Students wishing to arrange funding for ineligible programmes or for ineligible periods of study may have the option of arranging a Private Alternative Loan. The following are currently approved lenders with the University of Edinburgh:

Part-time study: If you are studying part time at the University of Edinburgh this may affect your entitlement for Federal Aid. Periods of study on a less than half-time basis are ineligible for Federal Aid.

If you change from full time to part-time study, this may affect your visa status. Please contact the Student Immigration Team for further information.

Visiting students attending the University of Edinburgh for one semester or for a full academic year will normally apply for Financial Aid through their home institution. Those who require a consortium agreement to be completed should email the form to the University's Financial Aid Office. Where a consortium agreement is in place, funding will continue to be arranged by the visiting student's home institution rather than the University of Edinburgh.

Checklist

Tasks you need to complete for a successful US Loan Disbursement

| Step | Task | Description | More Information |

| 1 | Check your Eligibility |

|

|

| 2 | Accept your offer of admission and start searching for accommodation. |

Undergraduates

Postgraduates

Accommodation

|

Admission Offices Contact Details |

| 3 | Request a CAS |

|

How to request a CAS number |

| 4 | Submit your FAFSA or private loan application |

|

|

| 5 | Complete a US Loan enquiry form |

|

US Loan Enquiry Form |

| 6 | Federal only - Complete your Master Promissory Note(s) |

|

Sign your MPN here |

| 7 | Federal only - Complete Entrance Counselling |

|

Complete your Entrance Counselling here |

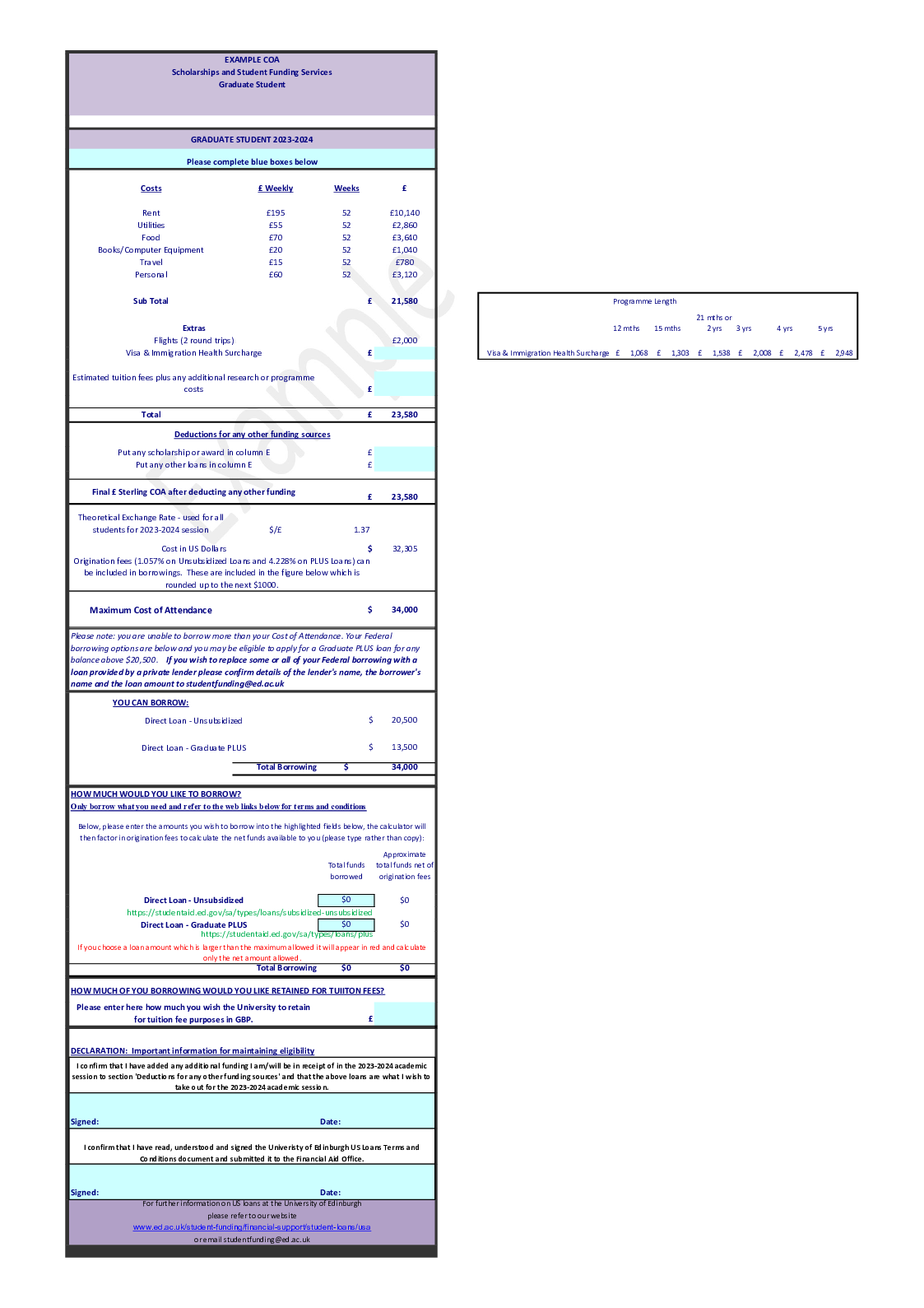

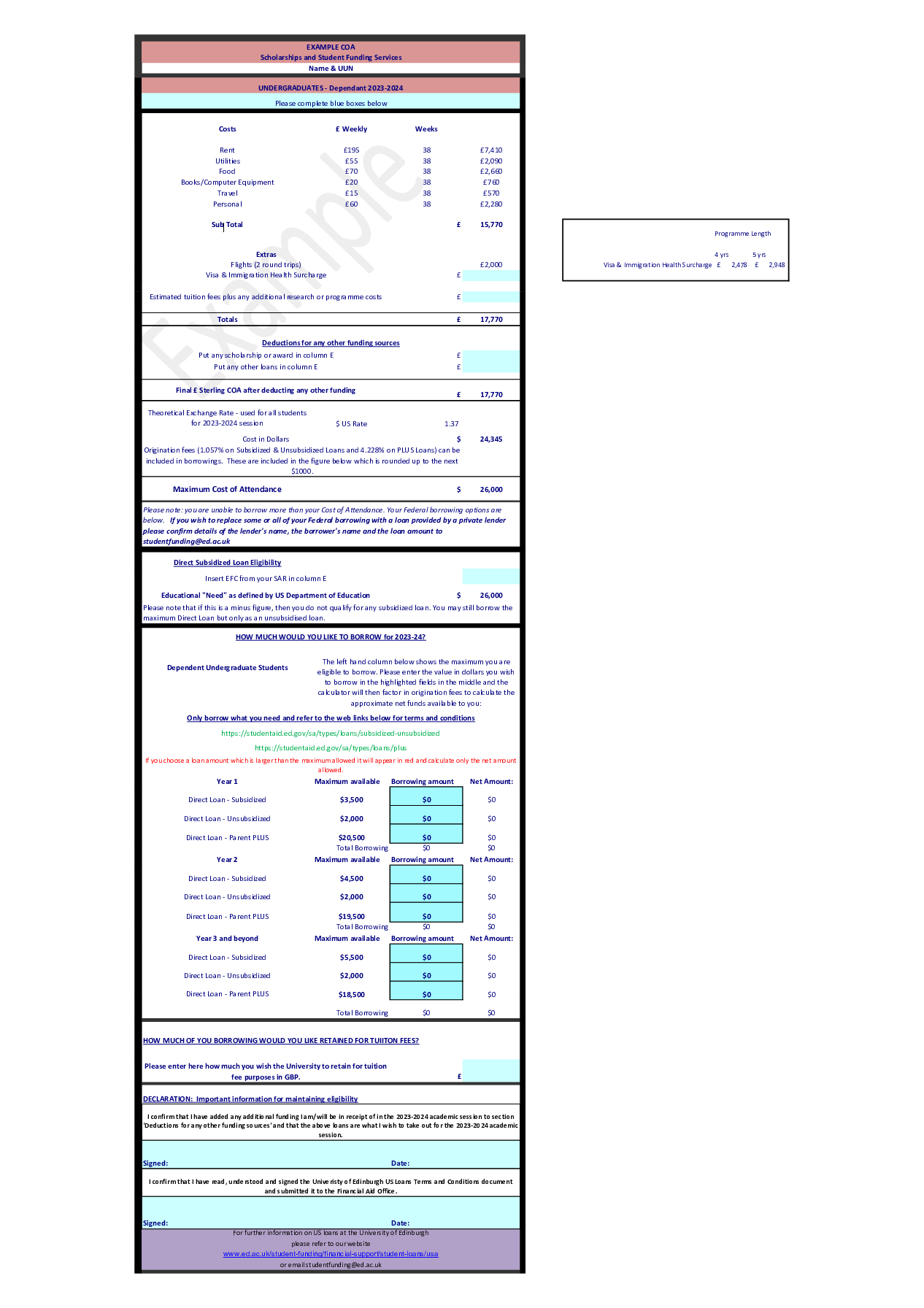

| 8 | Receive a Cost of Attendance (COA) |

|

Example COAs: |

| 9 | Receive a Funding Confirmation Letter |

|

|

| 10 | Setting up your bank account |

|

|

| 11 | Confirm how your are planning to pay your Tuition Fees |

|

Register How to Pay your Fees |

| 12 | Complete matriculation |

|

Step by step guide to matriculation |

| 13 | Federal Only - Submit Parent PLUS consent (Undergraduate only, if applicable) |

|

URGENT- Parent PLUS consent |

| 14 |

Submit Bank Details |

|

|

| 15 | Request an increase or decrease or cancellation |

|

Increase/Decrease/Cancellation Request Form |

| 16 | Federal only - Complete Exit Counselling |

|

How to complete Exit Counselling |

Loan Limits

The amount in Direct Loan funds that you are eligible to borrow each academic year is limited by your grade level; whether you are a dependent or an independent student; your financial need; and your cost of attendance.

You cannot borrow more than your financial need or the cost of attendance.

Annual Loan Amounts

| Dependent Student | Base Amount (Subsidized or Unsubsidized) | Additional Unsubsidized Loan | Total Annual Combined Maximum Amount of Subsidized & Unsubsidized Loans |

| First-year undergraduate | $3,500 | $2,000 | $5,500 |

| Second-year undergraduate | $4,500 | $2,000 | $6,500 |

| Third-year and beyond undergraduate | $5,500 | $2,000 | $7,500 |

| Independent Student (and Dependent Students Whose Parents are Denied a PLUS Loan) | Base Amount (Subsidized or Unsubsidized) | Additional Unsubsidized Loan | Total Annual Combined Maximum Amount of Subsidized & Unsubsidized Loans |

| First-year undergraduate | $3,500 | $6,000 | $9,500 |

| Second-year undergraduate | $4,500 | $6,000 | $10,500 |

| Third-year and beyond undergraduate | $5,500 | $7,000 | $12,500 |

|

Postgraduate student- |

Base Amount (Subsidized or Unsubsidized) | Additional Unsubsidized Loan | Total Annual Combined Maximum Amount of Subsidized & Unsubsidized Loans |

| Any year | $0 | $20,500 | $20,500 |

Direct Loan Aggregate Loan Limits

| All Students | Subsidized Only | Total Aggregate (Subsidized and Unsubsidized combined) |

| Dependent undergraduates | $23,000 | $31,000 |

| Independent undergraduates | $23,000 | $57,500 |

| Postgraduate students | $65,500 | $138,500 |